On 1 April 1842 the Renfrewshire Bank in Greenock stopped all payment causing widespread panic in the area. It was reported that -

"The whole town was in commotion, and

men, women and children were seen

running in all directions, hurrying from shop

to shop,

and place to place, seeking change of Renfrewshire Bank notes."

As word of the Renfrewshire Bank's failure

spread people started arriving in Greenock from all over hoping to change their Renfrewshire Bank notes and withdraw money from their accounts. There was a general run on all the local

banks until it was ascertained that it was only the Renfrewshire Bank that had

failed. Many local people, shipowners, business

owners, shopkeepers and small savers lost just about everything.

|

| Former Renfrewshire Bank premises in Bank Street, Greenock |

Archibald Speirs of Elderslie,

Boyd Alexander of Southbar, Renfrewshire,

John Cunningham, a merchant in Port Glasgow,

Alexander Dunlop, magistrate of Greenock

John Hamilton, merchant in Greenock

William Napier of Blackstone (near Paisley)

Charles Stirling of Kenmuir, a West Indies

merchant

Peter Speirs of Culcreuch, Glasgow tobacco

merchant

James Patten, of Greenock, formerly with

the Greenock Bank

The death of Alexander Dunlop of Keppoch in

1840 seems to have been the tipping point in the Bank's downfall.

The only original partner remaining was William Napier. Roger Aytoun had been admitted as a partner

in 1820. He was a former army captain (92nd

regiment) and brother in law of William Napier, having married Anne Napier in

1810.

The Renfrewshire Bank ceased on 1 April

1842 with liabilities of over £230,000.

John Ker, a Greenock merchant was made trustee. Holders of notes issued by the Bank prior to

1840 were paid by the estate of Alexander Dunlop (Keppoch), one of the original

partners.

William Napier, one of the remaining

partners, was described as "unmarried and of quiet and reserved manners,

and took no particularly active interest in public matters." Both he and

Roger Aytoun were declared bankrupt.

Napier sold his family estate of Blackstone, Renfrewshire in order to

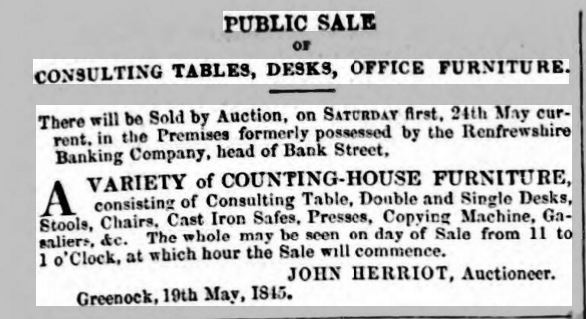

pay his debts. Even the Bank's fixtures and fittings were auctioned to raise money.

The failure of the Renfrewshire Bank had

long lasting effects for the people of Greenock and the surrounding area.. Many ships and houses were under mortgage to

the bank and banknotes issued by the

bank became almost worthless - just two shillings and three pence per pound. It was just one of the many small local banks which failed at this time. However the lovely building still remains in use as a rehabilitation centre in Greenock today.

...stability is an important part of life.

ReplyDeleteNo doubt one of their pounds would be worth a lot more now. I thing there were a few banks like that which went under then

ReplyDeleteInteresting post. It's no wonder people didn't trust banks after that for many a year.

ReplyDeleteI can imagine how unexpected the failure of the bank was, it must have influenced many peoples´ lifes.

ReplyDelete